Resources

FREE INFORMATION FOR YOU

- Sole Proprietorship

- Partnership

- “S” Corporation

- “C” Corporation

Run by one individual- (no partners are involved) You are entitled to all profits and are responsible for all your business’ debts, losses and liabilities.

A business entity with more than one partner that may act more like a company Allows for pass-through taxation of income LLCs and generally provide a flexible management structure.

This type of corporation elects to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. In other words, Profit and Loss Passes through to individual tax returns. Minimizes Self Employment tax (15.3%)

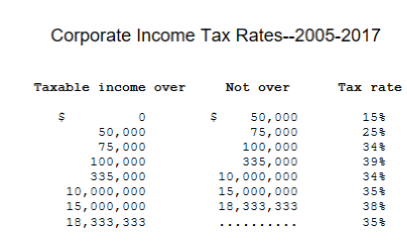

Different from an S corp, a C corporation is a legal structure for a corporation in which the owners, or shareholders, are taxed separately from the entity. This results in double taxation. C corps are subject to State & Federal rules.

- Form I-9 Employment Verification Form

- Form W-9 Request Taxpayer Identification Number

- Form W-4 Employee’s Withholding

- Form W7 ITIN Number Application

- Importance of Maintaining Good Record Keeping

- The Significance of Recordkeeping and time frames

- Income & Expenses: Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later

- Payroll Taxes: Keep all records of employment taxes for at least four years

- Selecting an Accountant and Professional Accounting Services Firm with a Result Oriented Mindset